100+ lenders are using Numerated to manage PPP lending and Forgiveness

December 17, 2020 -- Numerated, the leading business lending technology company for banks and credit unions, announced today it will fully-automate lending for the next round of Paycheck Protection Program (PPP) funding being negotiated in Congress to address the coronavirus pandemic.

During the first round of PPP lending in April, Numerated launched digital lending solutions for more than 70 lenders in a 48-hour period. As lenders brace for another surge in loan demand, the company is prepared to launch both existing and new customers just as quickly in this next round.

“Everyone in banking remembers their channels being overwhelmed, the race to secure approvals, rekeying applications into the SBA portal, the changing guidance, and the enormity of the pressure to deliver for businesses,” said Dan O’Malley, co-founder and CEO of Numerated. “Digital lending technology was critical for lenders to handle the overwhelming volumes then, and will be equally important in this next round with their internal teams also underwater with Forgiveness.”

More than 25,000 bank and credit union employees have used Numerated to process more than $34 billion in PPP relief funds, protecting more than 250,000 small businesses and 2.3 million paychecks. At the height of the program, Numerated’s platform was approving three PPP loans every second at a rate of $250 million per hour through its E-Tran API integration.

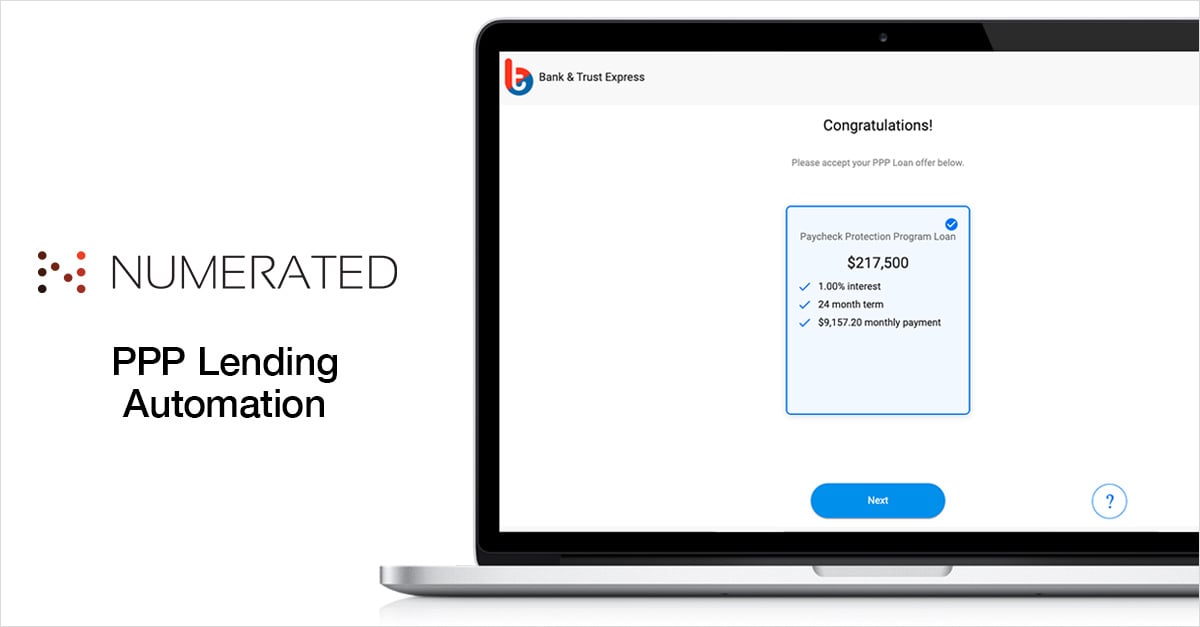

Numerated’s platform is unique in fully-automating PPP lending, saving lenders and borrowers thousands of hours of time and frustration. This includes using data and API integrations to autofill applications with business information, programmatically secure approvals from the Small Business Administration, automate document package creation, and streamline the boarding of loans to the core.

“The lenders we work with are preparing to manage what they anticipate will be another rush to secure approvals. We’ve been in the trenches with them for weeks anticipating challenges and developing solutions for this next round of PPP,” said O’Malley.

After the closing of PPP lending earlier this year, Numerated continued to invest development cycles into improving its digital lending solution for PPP. New capabilities include enhanced support for borrower self-service journeys, an intuitive user interface, a native document upload portal, and enhanced E-Tran error monitoring, DocuSign integration, and reporting features.

Beyond technology, Numerated supports the community of lenders using its platform for PPP with access to thousands of training resources, proactive program communication and data insights, and twice weekly webinars to ensure success.

To learn more, visit www.numerated.com.

About Numerated

Numerated makes it easy for businesses to purchase financial products from banks and credit unions. Financial institutions use Numerated to create award-winning digital lending and digital account opening experiences powered by rich data integrations and artificial intelligence. Numerated was recently recognized as one of 2020’s Top 250 FinTechs by CB Insights, 2020’s Best Overall FinTech Software by FinTech Breakthrough, and 2020’s Most Innovative Industry Partner by Barlow Research. Numerated powers business lending for 100+ top business banks, including Bremer Bank, Dollar Bank, Eastern Bank, MidFirst Bank, People's United Bank, Pinnacle Bank and more.