🎉 Webinar On Demand: SBA 7(a) Lending With Numerated Access Now →

-Img-10%25.png)

-Img-50B.png)

-Img-94%25.png)

Karen Mills, Former Head of the SBA and Numerated Advisor

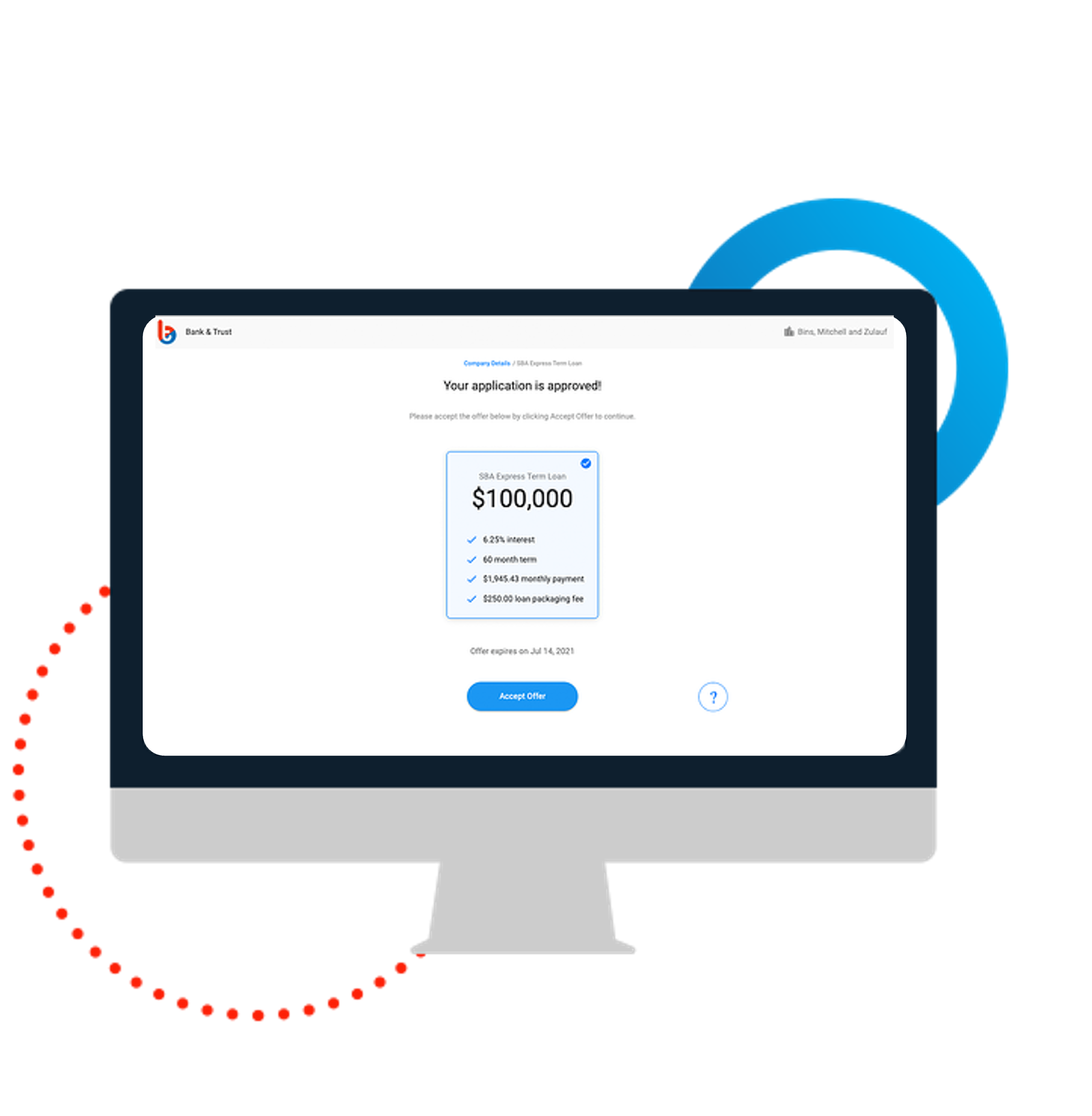

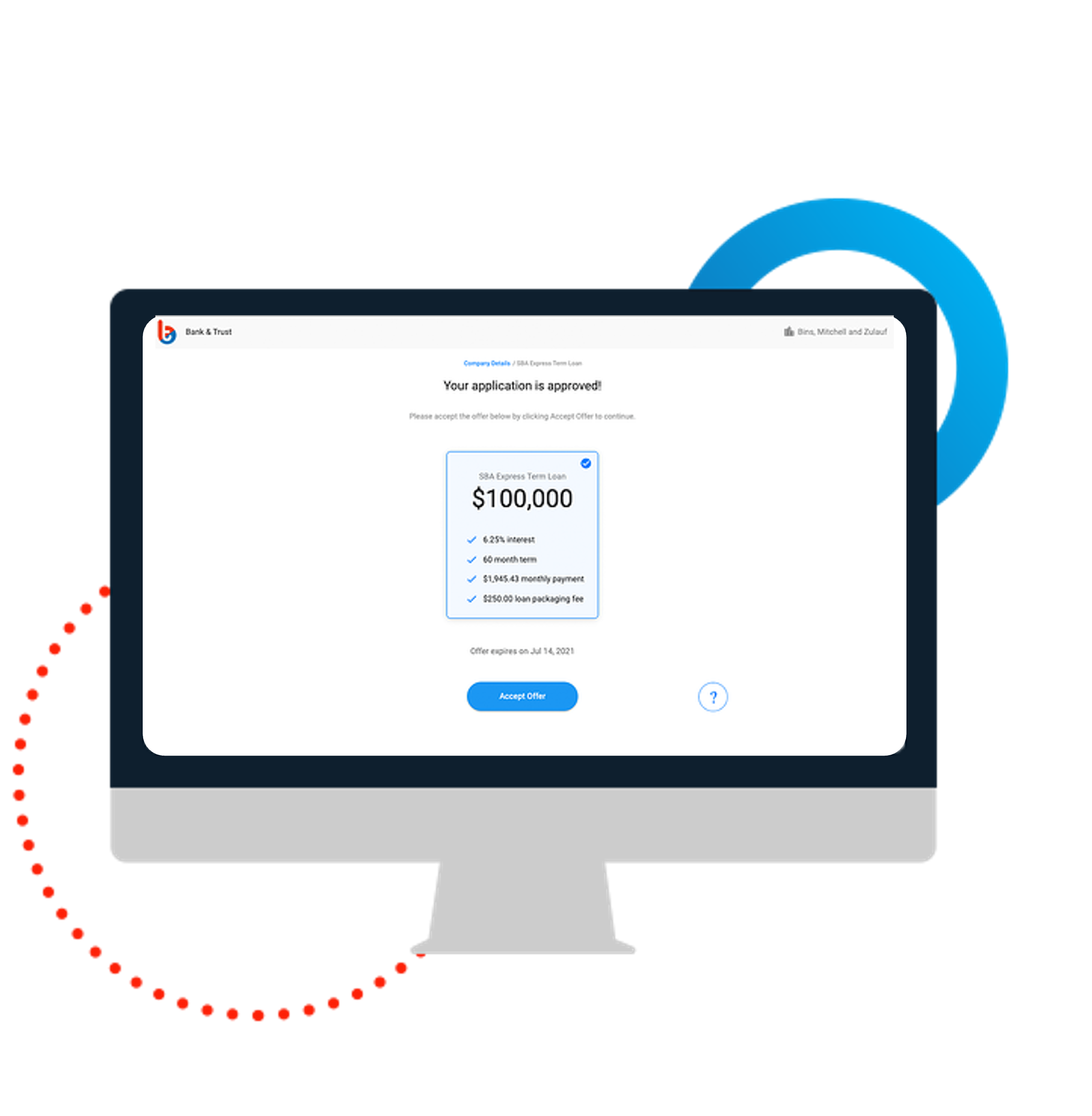

Before: Appointment back and forths, unending paperwork, borrower follow-ups, and more can quickly turn an application into a 10+ day process─if everything goes smoothly.

Now: Goodbye to tedious, error-prone manual processes. With Numerated's SBA 7(a) solution, the entire loan process is automated from beginning to end─reducing application and underwriting time by 75%.

-ImgPhone-1-1.png)

1. Dynamic application guides borrowers, pre-filling forms with data from your core and Secretary of State.

2. We flag any errors or omissions and prompt the borrower for clarification.

3. Our software auto-generates all required SBA forms, including Form 1919 and 1920.

4. We submit all required information to the SBA on your behalf and provide SBA responses on the platform.

5. Borrowers get real-time updates in our user-friendly interface and can e-sign loan documents when ready.

-Img-2.png)

The average time to complete an SBA 7(a) loan is 2-3 months. This can be a daunting task for busy business owners, often leading to delays in the loan process.

With Numerated, borrowers can easily and quickly complete the form independently, without needing assistance from a loan officer. This saves time and reduces the barrier to entry for borrowers who may be intimidated by the forms.

Newtown Bank Partners with Numerated to Transform Small Business Lending Segment

Numerated Expands Strategic Partnership with JAM FINTOP

Numerated Wins Second Consecutive "Best Lending Platform" Award from Fintech Breakthrough

What Lenders Need to Know About Section 1071

Numerated Ranks No. 7 on the 2023 Inc. 5,000 Regionals Northeast List

Get Started with Digital Account Opening for Businesses

Growing Top Talent and Creating Commercial Bankers Faster

Numerated Ranks No. 29 on the 2022 Deloitte Technology Fast 500™