Digital Lending

Award winning digital borrowing experiences that keep banks in control of their credit destinies

Make it easy for businesses

to borrow from your institution

Go beyond digital applications with digital lending solutions that provide businesses with fast decisions and offers on credit.

Banks and credit unions using Numerated streamline decisioning without sacrificing credit control. Apply different degrees of decisioning automation and workflows by credit product to align with risk cultures, existing technology, and resource availability.

Numerated offers digital lending solutions across a growing number of business banking products, including term loans, lines of credit, SBA loans, overdraft, credit cards, equipment loans, working capital lines and owner-occupied real estate.

Bank-Controlled Automation

Apply as much or as little credit decisioning automation by product. Choose from a spectrum of decisioning solutions, from streamlining manual underwriting with data collection to enabling full real-time lending that take customers from application start to account funded in as few as 3 minutes.

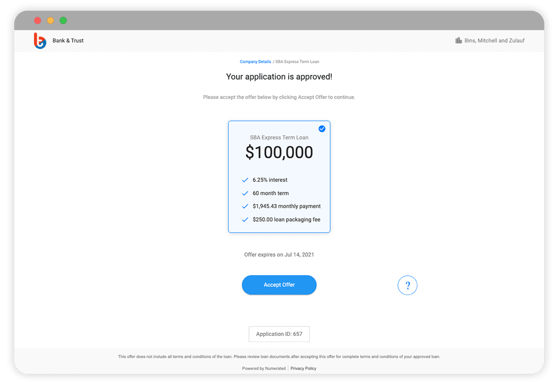

Digital Offers & Counter Offers

Quickly present businesses with digital offers, including both binding or non-binding offers. Create advanced counter offer logic with waterfall decisioning that ensures declined businesses are matched with other products to meet their needs.

Integration Ready

Leverage Numerated’s digital lending capabilities in concert with existing bank technology with off-ramps available at multiple points in the digital lending process, including to document management systems and loan origination systems.