Buying a new car today for personal use is so easy, there’s now an app for that. Actually, there’s at least eight apps for that.

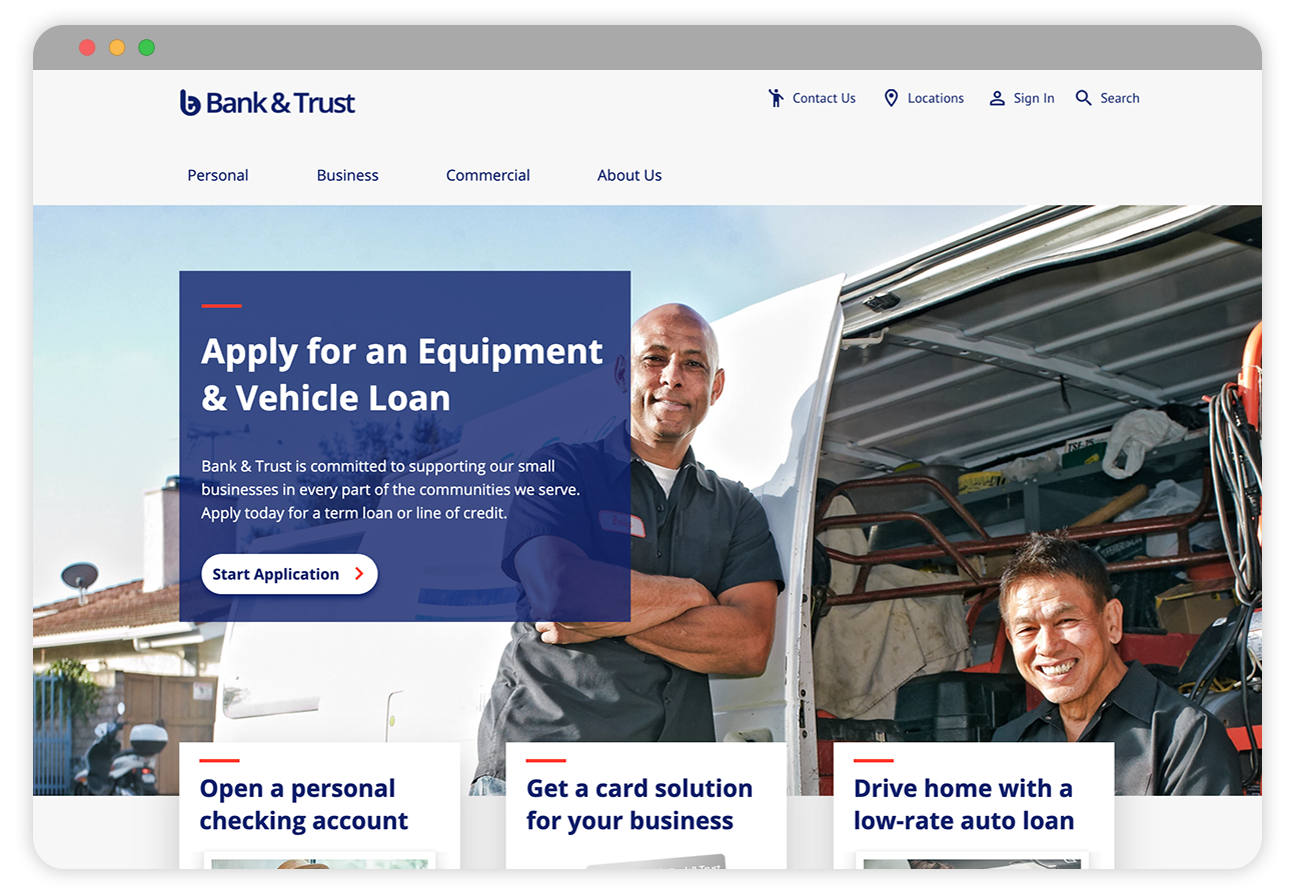

But if you need a new piece of equipment or vehicle for your business, that’s another story. Unlike the car you drive to work, the kinds of equipment and vehicles businesses buy are often more complex pieces of machinery, and therefore are far more expensive.

These kinds of purchases require lonas that need to be secured with specific types of collateral. And, whenever collateral is brought into the equation it usually means more paperwork for the borrower and the bank or credit unions they’re working with.

During a recent weekly webinar, we asked bank and credit union attendees how they handle business equipment and vehicle loans at their institutions. About half said the entire process was done with pen and paper. An additional 44 percent said they leveraged some mix of paper and Excel spreadsheets. Just six percent reported having a digital experience available for their business customers.

This came as no surprise to our team at Numerated. For the last 12-18 months, Secured Lending for Equipment and Vehicle loans has been one of the most commonly asked for features among partner institutions.

In order to take the work out of equipment and vehicle lending for financial institutions and their clients, we needed to make the platform capable of facilitating a loan product that is secured by a particular asset or set of assets, as opposed to all of the assets of the business, for example.

Consider then, what the process of securing an equipment and vehicle loan--sometimes exceeding as much as a million dollars--looks like. While this process might vary from institution to institution, it probably looks something like this:

- Collect information on a particular asset or set of assets: The bank or credit union needs to gather information and documentation about the particular asset or set of assets used to secure the equipment and vehicle loan. This could include descriptions of the asset, asset serial numbers or Vehicle Identification Number (VIN) if it’s a vehicle, and/or copies of invoices used to purchase the asset.

- Generate a UCC filing: Financial institutions must file a legal notice known as the UCC-1, which puts on record the bank’s or credit union's interest in a debtor’s asset or set of assets.

- Calculate debt service coverage ratios: A lengthy and often complicated analysis, lenders calculate debt service coverage ratios in order to better understand sources of repayment.

- Help borrowers apply and process their loans: In addition to collecting information on assets, generating UCC filings, and calculating debt service coverage ratios, banks and credit unions also need to complete all of the steps of a typical loan experience. That means helping borrowers fill out lengthy applications and collecting documents and signatures manually, all while handling the back-and-forth communications of such a customer interaction.

The process described above is grueling, to say the least. It requires a ton of physical paper and person-to-person interaction. Not to mention the tedious exercise of keying and re-keying information into disparate systems. As many banks and credit unions have intuited, this is a process that can be made dramatically more efficient if the right tech were made available.

Digital lending platforms like Numerated accomplish this by expanding already successful businesses banking user experiences to accommodate more complex products.

This means incorporating third-party data--for example, integrations with Dun and Bradstreet, LexisNexis, and Instant ID--to ensure those applying for loans are appropriately associated with the business and to provide scoring metrics around risks and the individuals behind them.

It means creating fast, easy, and completely digital application experiences that provide logical processes with email notifications and really thorough tool tips to help guide users, whether they’re working with a banker or have chosen self service.

In leveraging a digital lending platform like Numerated, banks and credit unions can:

- Make collateral detail collection easy by digitally requesting specific details on assets for security liens, in addition to support for all business asset liens.

- Enrich applications with third-party data aggregation that flags areas of risk to inform focus issue analysis.

- Automate debt service coverage ratio calculations and collateral coverage analyses to provide insights on sources of repayment.

- Eliminate rekeying and manual work with automated generation of UCC documents.

With one of the fastest implementations available in the industry, banks and credit unions can begin automating equipment and vehicle loans using Numerated in weeks, instead of months, allowing them to quickly recognize efficiencies.

To learn more about Numerated’s equipment and vehicle lending capabilities, watch a full, on-demand demo here.