Consumers today are pretty self sufficient when it comes to their personal finances. From new accounts, to auto financing, to mortgages, the next loan or line of credit is usually only a few clicks away.

I myself have primarily banked with a brancheless institution for years, and have only ever had to interact with another person on a handful of occasions. But if I need a new term loan or line of credit for my small business, my options are much more limited and almost always involve a visit to the branch.

By their very nature, business banking products are more complicated to sell and require more one-on-one interactions between business owners and their lending counterparts. The conventional wisdom for years has been that these products and services are too onerous to bring online, and even if that kind of digitization was possible, borrowers would still prefer traditional methods.

Based on the data we’ve pulled from our platform, however, the Paycheck Protection Program turns this old notion on its head.

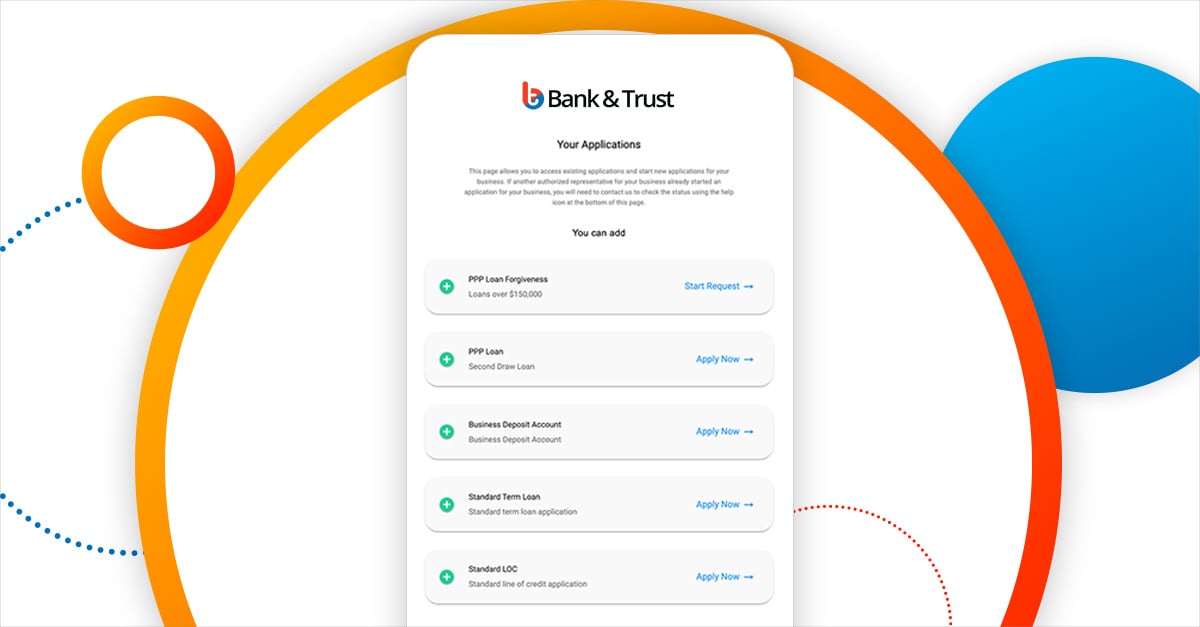

More than 130 lenders used the Numerated Platform to process more than 500,000 First and Second Draw PPP loans over the past year. In Round 3, nearly every lender (96 percent) offered borrowers access to a self-service portal—a place where borrowers could start a new PPP loan application, securely upload required documents, submit to the lender, and receive a decision through, without ever requiring the assistance of the institution.

As compared to Rounds 1 and 2 where applications were banker-led, in Round 3, lenders offered both banker-led experiences and self-service experiences; borrowers overwhelmingly chose to complete the PPP loan experience on their own. In fact, 83 percent of all borrowers who applied for a PPP loan using the Numerated platform in 2021, did so via self service.

Furthermore, an examination of borrower satisfaction with the experience underlines that self service for business banking is a trend that’s here to stay.

Earlier this year, Valley National Bank, a $42 billion regional banking leader with over 200 locations, surveyed customers that used this self-service experience to secure their PPP loan. Of the businesses surveyed, 92 percent said the digital application was easy to use and 87 percent said the self service experience made them confident in applying for these complex federal aid loans.

“The PPP has made it very clear that commercial clients appreciate a streamlined, digital application process,” Valley National Bank EVP and Chief Financial Officer Rick Kraemer said at the time. “Historically, online applications have been reserved for our consumer products, but this experience has taught us our commercial customers welcome this same level of online convenience.”

Valley National Bank isn’t alone in this sentiment. In a January poll we conducted with more than 600 banking executives, 64 percent reported that the mass adoption of these kinds of digital lending technologies will have a greater impact on their institutions this year.

As of now, March 31 represents the official end of this round of PPP originations and with future rounds of funding uncertain, many are looking at the end of this month as a pivot point away from PPP and toward a new normal.

While it’s difficult to predict the future there are a few things we know about what the post PPP business banking landscape looks like. As we discussed in our breakdown of the 2021 Federal Reserve Small Business Credit Survey, there’s pent up demand among small businesses that didn’t get the financing they needed last year—PPP or otherwise.

Banks and credit unions that participated in PPP will have a natural opportunity to extend these business banking relationships beyond the federal loan program when borrowers return to apply for Forgiveness, or to access their PPP documents for tax purposes. Knowing the demand that exists in the market, lenders should be ready to meet borrowers' needs.

That said, it’s financial institutions that can meet those needs through the preferred self-service customer experience, that will have a natural advantage against their competition when PPP expires at the end of this month.

For more insights, join one of our twice-weekly webinars by registering here.