Business lending has become intensely competitive. A shift to all things digital is changing the face of business banking, forcing relationship banks to make critical decisions about their business lending strategies.

Charles Wendel of Financial Institutions Consulting has published a great series of thought leadership around small business lending. Often banking institutions look to ‘check the box’ when it comes to digital, which can inadvertently lead to an evaluation framework based on the path of least resistance. This rarely solves underlying challenges nor leads to the best outcomes. He encourages bank executives to:

“understand their bank’s current portfolio and process flows, well before considering a technology solution.”

We agree. To add to his commentary and insights, we suggest that banks understand their people flows. People are behind both the bank, and the business. And we believe digital lending technology should enhance these relationships, and not necessarily replace them—an approach we often refer to as relationship-based digital lending.

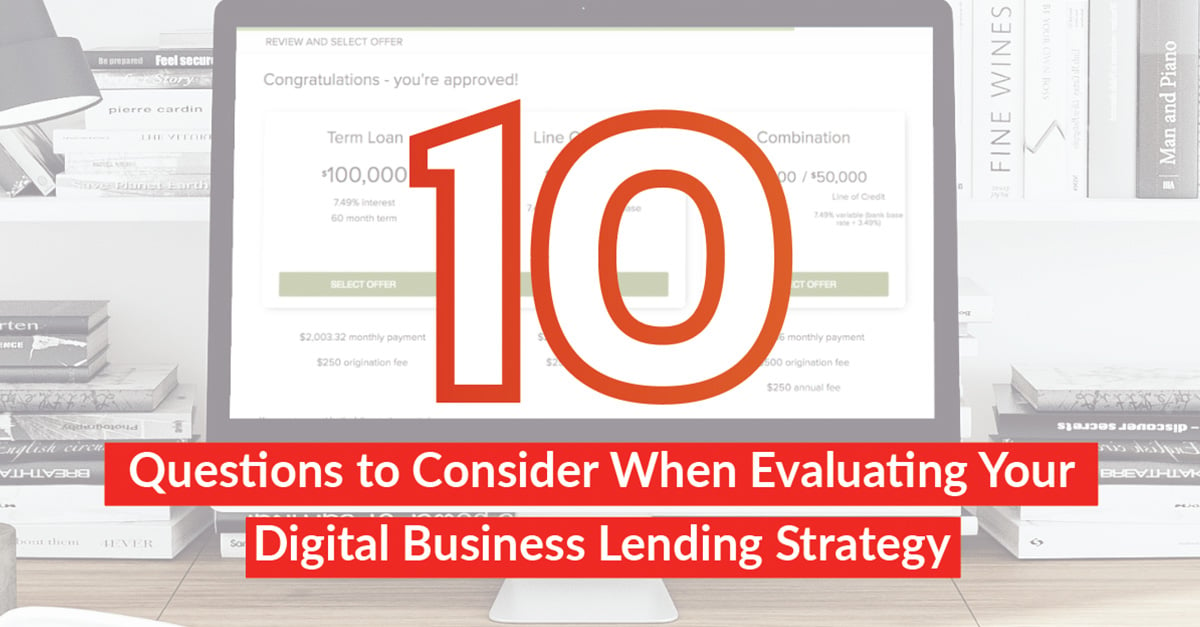

Whether you’re building, buying or partnering to digitize business lending, we recommend banking executives consider these 10 prescriptive questions when evaluating their digital lending strategies.

1. Can you identify the lendable businesses in your markets?

Many banker and retail banking teams aren’t talking to businesses about their credit needs or about the bank’s credit products, simply because they are unsure whether or not a business is lendable. Why would a banker ask a business to go through the application process if there is risk of being declined? The ability to quickly understand and identify if a business is qualified for bank credit products, before ever engaging them, is the foundation to a scalable digital lending strategy.

2. Do your bankers and retail bankers receive qualified lists of prospects?

Understanding business eligibility among both existing customers and prospective businesses also maximizes the efficiency and impact of banker and retail banking teams. Imagine the productivity gains of having a new, prioritized list of qualified businesses in your market delivered to your inbox every morning. This includes identifying low-hanging fruit, like your existing customers with loans with alternative lenders and competing banks, and qualified prospective business targets like those in particular industries or within close proximity to branches.

3. Do you want a customer experience that is consistent across channels?

Across just about every sector, digital has redefined what service means to center on convenience and choice. When it comes to business lending, a convenient and consistent experience across channels can breed brand advocates. On the other hand, a disjointed and disconnected customer experience can generate frustration levels so high they turn customers away from the bank forever. A consistent and integrated customer experience across bank channels means a business owner can begin an application online and complete it in a branch, or begin an application with the help of a banker over-the-phone and be completed on a smartphone in the comfort of the applicant's home. Bank staff should have access to applications in flight, and the customer should have convenience and choice across bank channels.

If you found these 3 questions helpful, we encourage you download our latest ebook for the complete set of 10 questions to keep in mind as you evaluate your banking institution's digital business lending strategy.