In February, the economy added another 678,000 jobs; just the latest signal that 2022 could be a big year for American businesses.

Those watching the economy, like Marketplace’s Justin Ho, have already reported on hints that small businesses were gearing up for a rebound as demand for C&I loans picked up toward the tail end of 2021. That demand has sustained itself during the early parts of the first quarter, a trend that has continued, in part, due to rising inflation.

The current environment makes small business lending a key channel of growth for financial institutions in 2022. But how banks and credit unions approach this opportunity differs from institution to institution.

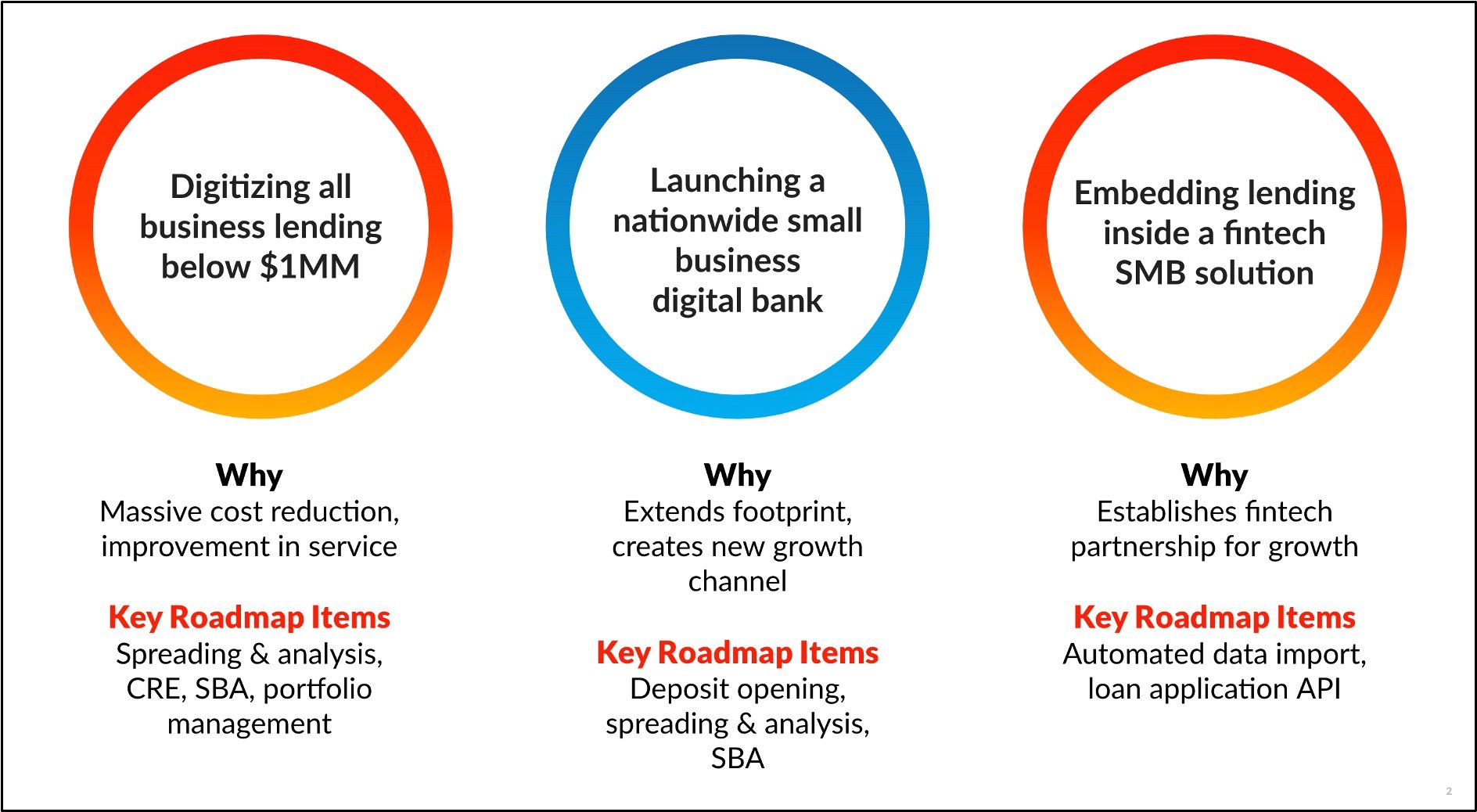

Three digital lending strategies for business banking Numerated users are deploying in 2022

Those that have invested in modern loan origination systems like Numerated, will have more flexibility in their strategy—and therefore more advantages—than traditional lenders.

To date, Numerated has worked with more than 140 financial institutions to process over $50B on our platform. Each partner institution we work with has a unique approach to the small business lending segment, but there are three strategies in particular that we’re seeing more and more often:

- Digitizing all business lending ≤ $1M: In terms of the three strategies described herein, this one is the most common. Banks and credit unions are leveraging a wide range of platform capabilities, from automated spreading and financial analysis to portfolio management, in order to digitize term loans, lines of credit, Small Business Administration loans, commercial real estate, and other business lending products. Although simple, this strategy will have a major impact on the institutions executing it by providing a significant boost in efficiency, customer experience, and industry perception among prospective customers.

- Expanding regional and national reach: One interesting data point to come out of the Paycheck Protection Program—which we discussed in our playbook on growing small business lending in 2022—was that community banks that invested more in technology, originated a greater share of the PPP loans regardless of a borrower’s proximity to the institution’s branch. In other words, banks and credit unions that leveraged modern loan origination systems like Numerated’s were able to expand their footprint, reach more prospects, and convert more customers. In 2022, many of our partner institutions are building on this lesson and combining the platform’s ability to provide an end-to-end digital experience for business loans, with powerful deposit account opening features, to expand their footprint regionally, and even nationally.

- Embracing Banking-as-a-Service (BaaS): If loan origination systems are the main stream of business banking technology today, then BaaS is on the next horizon. Today, we’re working with a few leading financial institutions to help them embed their business banking products within other fintech platforms. Think platforms like LendingTree, but rather than targeting homebuyers, these platforms are geared to serve business owners in need of loans and other business banking products. BaaS is by no means the entirety of these partner institutions’ small business lending strategies, but the Numerated platform provides the flexibility they need to test new channels for growth. Channels that would otherwise be inaccessible to these community institutions.

Doing more with the Numerated Loan Origination System

For years we’ve helped financial institutions enable the retail sales of their business banking products, open up self-service channels for borrowers, and drive success in microcredits. As we continue to invest in the future of the LOS, we’re also helping these institutions unlock innovative strategies, like the ones described above.

To learn how you can do more in business banking with the Numerated Loan Origination System, watch our recent webinar outlining our 2022 roadmap, here.