The pandemic proved the importance of efficiency in an unprecedented way by rapidly accelerating digital transformation within financial institutions across the country. This shift has led to major changes in the competitive landscape for banks and credit unions, especially in the space of small business lending. Before the pandemic, lenders were beginning to see a change as many financial institutions were slowly adopting new technologies, and digitally mature nonbank lenders were beginning to gain more market share.

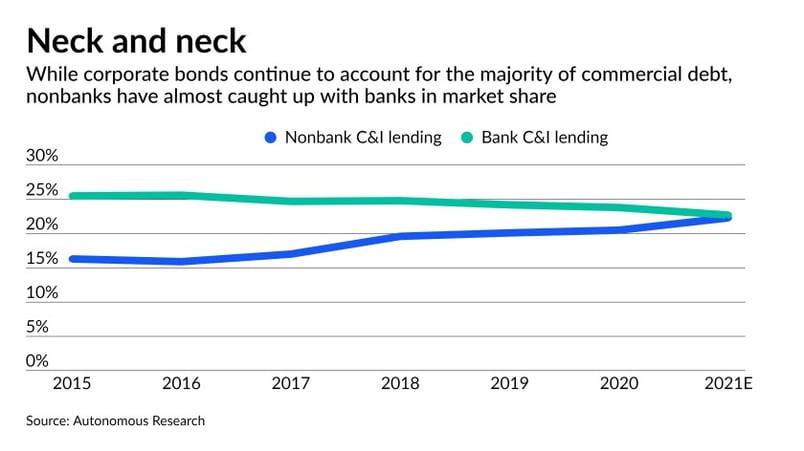

Today, the competition is fiercer than ever before, and nonbank lenders now own a greater share of the market. According to a recent American Banker Article, by the end of 2021 the amount of C&I loans held by banks will almost equal the amount held by nonbank lenders. As this growth continues for nonbank lenders, it’s important that banks and credit unions innovate their technology offerings quickly to ensure customer satisfaction and increase retention.

While alternative lenders pose a threat to many financial institutions, the biggest competition is most likely closer than one would think. As alternative lenders pave the way for financial institutions to digitally transform their offerings, many banks and credit unions have already acquired new technologies to improve customer experience.

With direct competitors like these offering the digital-first solutions borrowers demand, financial institutions that have not yet begun their digital transformation need to start the consideration process to remain competitive in 2022.

Empowering the Branch Through Digital Lending

Traditional banks and credit unions have always claimed exceptional customer service as their primary differentiator. But, in a world where borrowers can receive financing within minutes, the definition of exceptional customer service has radically shifted.

Now is the time to invest in technology that empowers the teams within your branches to meet today’s customer expectations by providing a seamless lending process.

A digital loan origination system can help banks and credit unions continue to fulfill their promise of putting the customer first and provide an exceptional customer experience by:

Providing an Omni-channel Approach

With fintechs and digitally-mature financial institutions making it possible to receive a loan completely online, it’s important that banks and credit unions also offer this level of convenience and efficiency. While some customers may opt in for this completely online process, others may choose to be guided through the process by a representative inside the branch. Because of this, lenders need to ensure they offer different ways for customers to interact with the branch. The goal should be meeting customers where they are, whenever they need to be met. A digital loan origination system makes it easy for banks and credit unions to service customers online, or in the branch—and can even allow borrowers to serve themselves.

Strengthening the Focus on the Small Business Lending Opportunity

Without the Paycheck Protection Program to supplement lending to small businesses, banks and nonbank lenders are left to fill the funding gap. This has presented an opportunity for banks and credit unions to grow in small business lending. Without the right technology, however, processing small business loans can be so tedious and time consuming that few institutions can rationalize the segment through traditional methods. Utilizing a digital loan origination system like Numerated’s allows lenders to save time and resources by radically reducing work for both the banker and the borrower, allowing institutions to focus on providing an exceptional customer experience.

Empowering Non-credit Trained Employees

Credit officers are critically important to the day-to-day functions of a financial institution. But these highly-skilled employees are also few and far between. This resource constraint limits the number of employees that can service borrowers and can lead to bottlenecks in a branch’s lending pipeline. A digital loan origination system can simplify the process to the point that any branch employee can help a business owner submit a loan application, allowing credit-trained employees to focus on the most important pieces of loan origination: spreading, underwriting, and decisioning. The result is a streamlined experience for the business owner, where they feel the branch has met their needs rather than wasted their valuable personal time.

When lenders are able to focus on developing their resources to streamline and enhance their customer service, they are able to create a branch that lives up to the promise of putting the customer first. Time consuming paperwork, long wait times, and speaking with multiple representatives before finding the correct one, are a thing of the past in the new normal.

Inside of today’s leading financial institutions, employees are empowered with the proper technology to serve as a resource to any and all customers. This enables the branch to withhold the standard of excellent customer service that they’re known for, and allows relationship banking to become digital-first.

Learn more how a digital loan origination system can help you rationalize your branch and grow your small business lending segment by downloading our playbook today!