Resources for Creating Exceptional Business Banking Experiences

Case Study: Auto-Decisioning Business Loans for Credit Unions

Unlock the secrets behind Vantage West’s 3.75x growth in business banking enablement.

SMB LOS Product Overview

Grow your business lending with an intuitive borrowing experience and quick lending decisions.

Fast Facts: Section 1071

5 things every business lender should know about section 1071 of the Dodd-Frank Act.

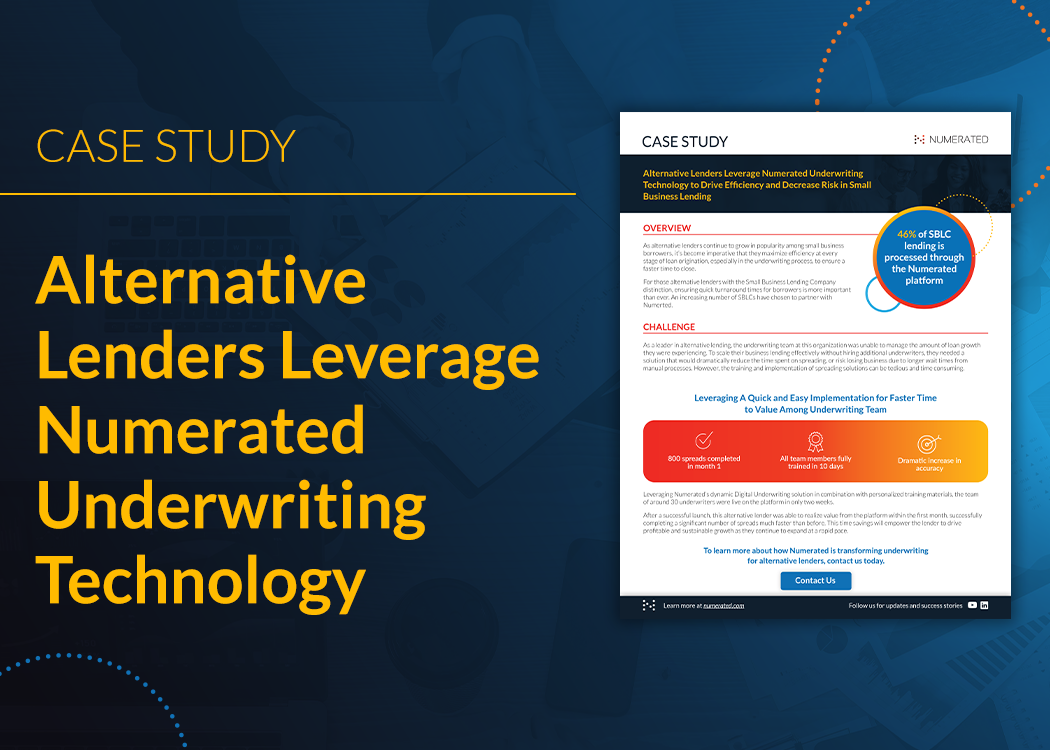

Case Study: Alternative Lenders Leverage Numerated's Underwriting Technology

Learn how alternative lenders are using digital underwriting to drive efficiency.

On Demand: Accelerate Your Underwriting Demo

Numerated has launched key enhancements to its end-to-end digital underwriting solution.

Video: Secrets to Building an Automated Decisioning Strategy

Watch Numerated and Dime Bank present at the RMA conference.

On Demand: Digital Account Opening for Businesses

Delight new customers and drive retail, self-service SMB and digital banking efficiencies.

On-Demand Webinar: Section 1071 Update & Product Demo

Learn more about Section 1071 requirements and how Numerated can help.

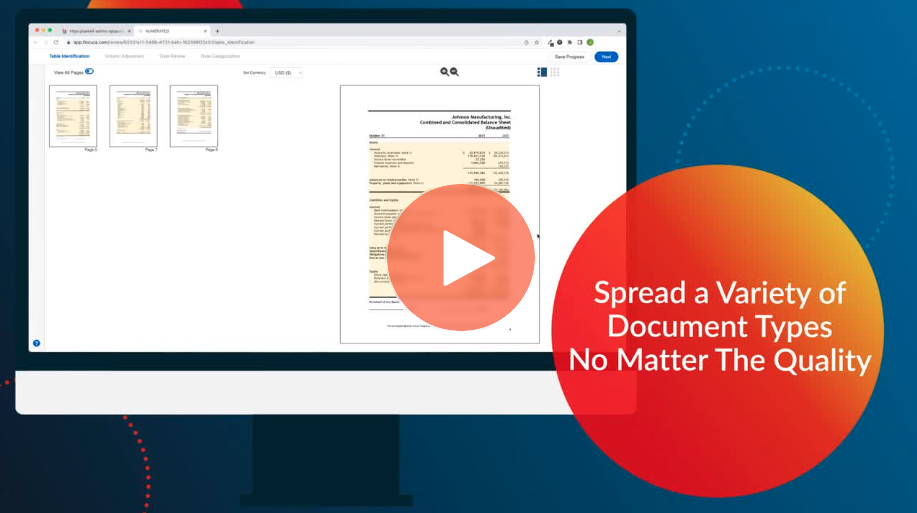

Product Snapshot: Digital Underwriting

Watch this short video for a look at Numerated's Digital Underwriting solution.

%20Mini%20Demo%20Image.png?width=921&height=517&name=SBA%207(a)%20Mini%20Demo%20Image.png)

Product Snapshot: SBA 7(a)

Watch this short video for a look at Numerated's SBA 7(a) solution.

On Demand: Digital Lending Demos

View our latest Term Loan & Lines of Credit and Digital Account Opening solutions.

Video: First Mutual Holding Co. Session

First Mutual Holding Co. joined us at AOBA'20 to talk about tech investments and priorities.

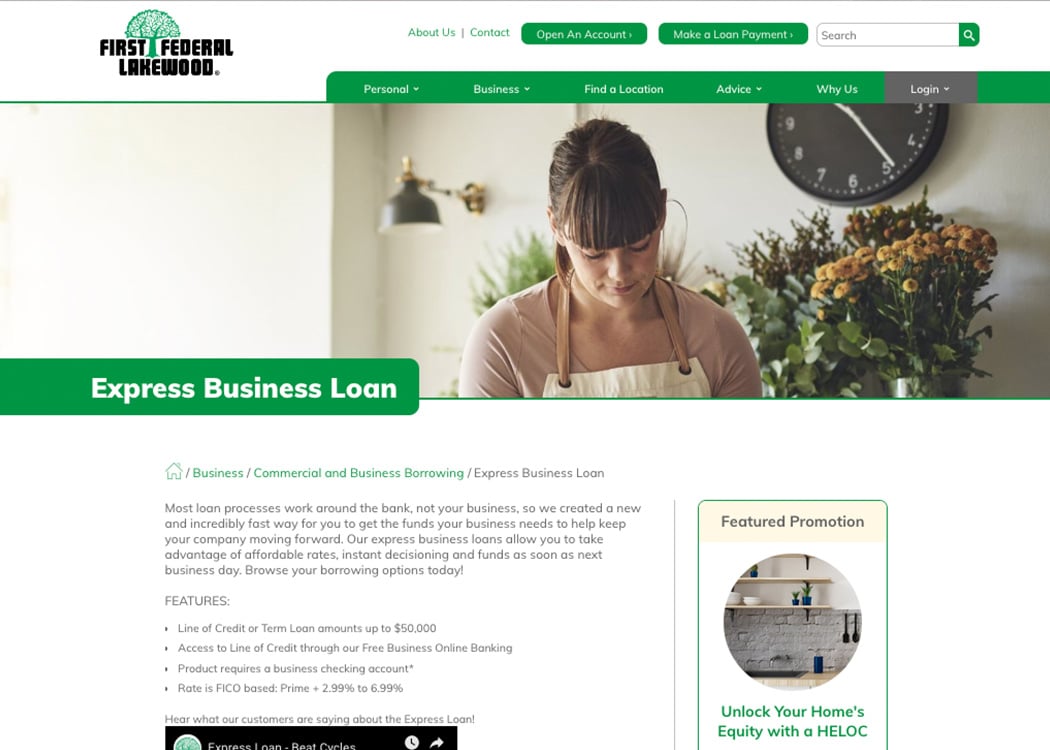

Case Study: First Federal Lakewood

First Federal Lakewood Grows Business Portfolio 3.4X in 2 Years with Numerated.

-1050x750.jpg?width=1050&height=750&name=BAI-Fireside-Chat(2)-1050x750.jpg)

Video: Dollar Bank Fireside Chat

Dollar Bank Discusses the Future of Relationship Banking at the 2019 BAI Industry Forum.

Watch

Digital Account Opening Product Overview

Learn more about Numerated's dynamic Digital Account Opening solution.

On Demand: How Bankers Built Numerated

Hear stories from Numerated's in-house banking experts on how their experiences in the industry shaped our product roadmap.

On-Demand Webinar: What Business Lenders Need to Know About Section 1071

Learn how your institution can easily become 1071 compliant with Numerated.

On Demand: 3 Playbooks for Success in Small Business Lending

Learn how our 3 playbooks can help drive profitable growth in business lending.

Ebook: Profitably Growing Your Small Business Lending

Better understand and articulate small business lending opportunities in 2022.

Video: Banker User Experience

How bankers at Eastern Bank use Numerated to attract and build relationships.

Digital Underwriting Product Overview

Learn more about Numerated's Digital Underwriting solution.

On-Demand Demo: Digital Underwriting

Experience lightning-fast spreading and underwriting.

A Numerated Product Demo: SMB LOS

Watch this short demo video to learn more about Numerated's end-to-end SMB LOS.

On Demand: Product Roadmap Review

View the new enhancements coming to the Numerated platform.

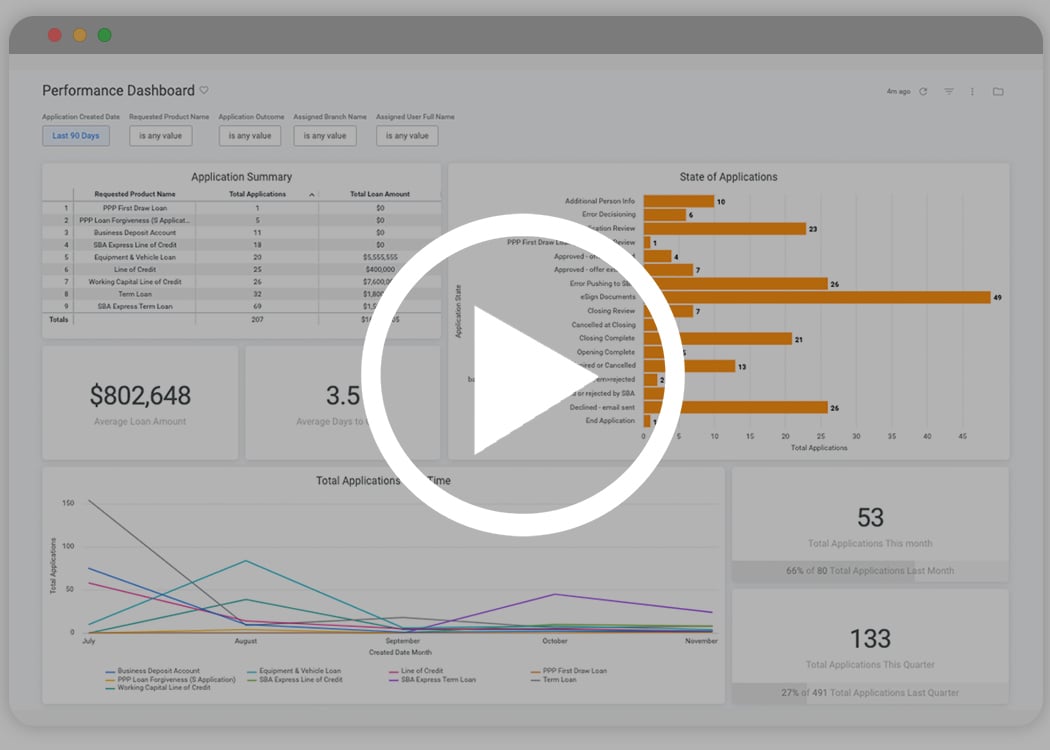

On Demand: New Reporting Dashboards Demo

Get the most out of your data with our new reporting dashboards.

Podcast: Bank Partnerships — a Growing, Diverse Ecosystem

A LendIt panel discussion around the recent trend of banks partnering with fintechs.